Retirement Planning

There are a complexity of rules governing the vast range of retirement planning options that are available to you. It is therefore important that once you have made the decision to fund for your retirement, that specialist and experienced advice is sought in order to provide you with the most suitable retirement planning structure.

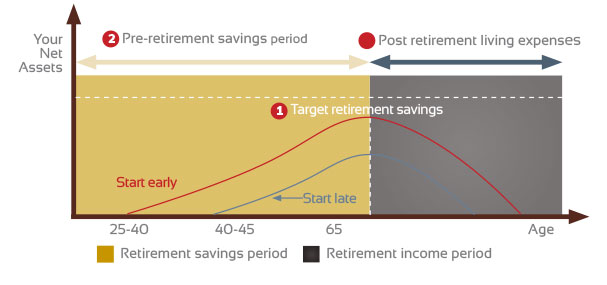

How much you should be saving will depend on your requirements at retirement. However, clients should not delay saving for their retirement. The earlier the contributions begin, the greater the investment value at retirement. This is not only due to the fact that more contributions can be made, but also due to the power of compounding.

Retirement planning considerations:

Retirement goal setting

Retirement goal setting Designing the investment strategy most suitable to your age and risk tolerance

Designing the investment strategy most suitable to your age and risk tolerance Analyse pre and post retirement options: Annuities & Approved Retirement Funds (ARF)

Analyse pre and post retirement options: Annuities & Approved Retirement Funds (ARF) Pension Reviews & Audits

Pension Reviews & Audits Cash extraction from your business

Cash extraction from your business Maximising tax efficiency and relief’s

Maximising tax efficiency and relief’s Self-administered and self-directed structures

Self-administered and self-directed structures

We devise retirement

plans for:

Business Owners & Company Directors

Business Owners & Company Directors Self Employed Individuals

Self Employed Individuals Executives

Executives Employees

Employees Pension Transfers

Pension Transfers Pension Consolidations

Pension Consolidations Group Pension Schemes

Group Pension Schemes

Retirement Lifecycle: