Introduction

Pension funds and investment portfolios have all been hit with the latest wave of high volatility and market uncertainty. 2022 is proving to be a very difficult trading year for investing and investment markets as inflation continues unabated and fears of a recession increase.

Higher risk assets like equities are down 10 to 20% year to date. Recent valuations have factored in the effects of inflation, impending recession, and the impact of the war in Ukraine on energy prices, to mention a few. Less risky assets like bonds are also down as interest rates increase. Central Banks around the globe have raised interest rates in an effort to combat inflation.

So what’s causing this uncertainty and is it going to continue?

Inflation

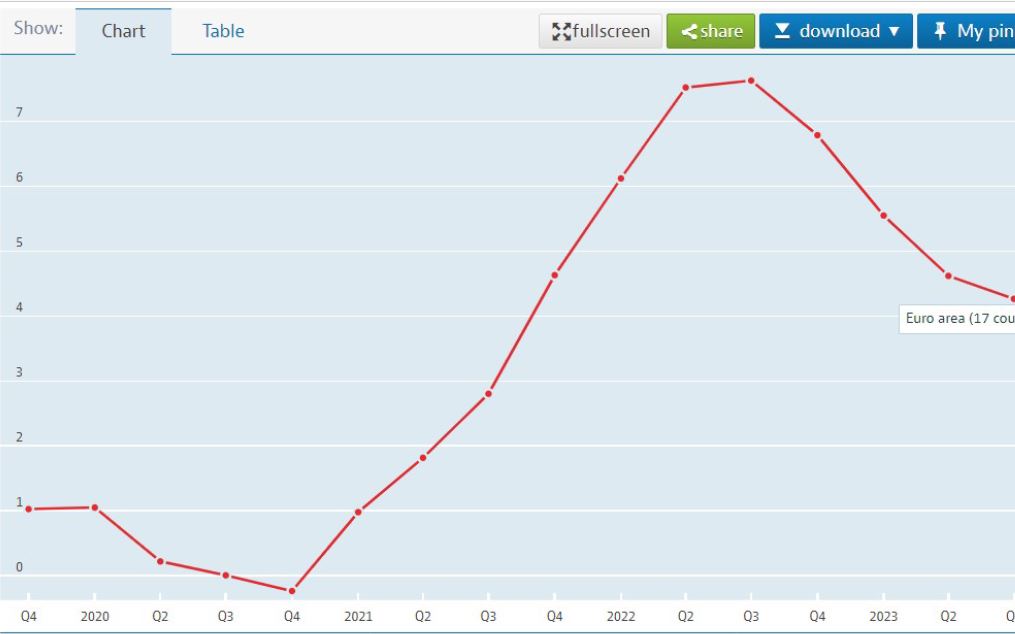

While no one can predict the rate of inflation in the future, the OECD suggests that it will spike next year. Then we should see a return to more normal rates beyond that. The chart below shows this inflation forecast.

Interest rates

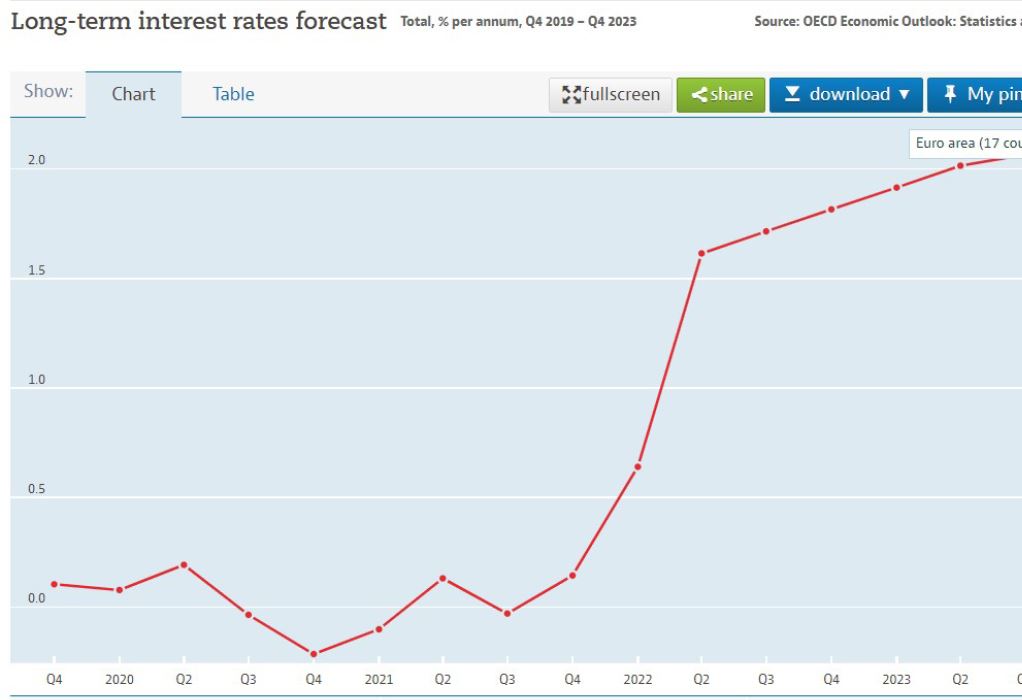

Central Banks certainly need to be prudent here to get the balance right, between maintaining growth with the threat of recession looming. The long-term forecast as shown below shows stabilisation but at a higher level.

Recession

The case is that many are now predicting that it is only a matter of when, and not if, the global economy goes into recession. Historically the average duration over the past 100 years has been between 6 – 18 months, so it doesn’t have to mean such bad news.

War in Ukraine

The Russian invasion of Ukraine in early 2022 sent investment markets falling. While the war continues, it is impossible to predict what will happen here. So for the time being, it’s safe to say that oil and gas prices will remain high. This is likely to slow corporate growth.

Global Supply Chain

The global supply chain is under duress. Whether this is down to labour shortages, cost of freight, structural or other supply chain issues, it is taking its toll on many larger and more profitable companies.

Understanding Risk

Volatility has always been part of investing. Understanding risk and how the market has its ups and downs are all part of investing. History has shown us time and time again that the prudent investor, who holds their position, is rewarded for staying the course.

If you believe the market is an efficient mechanism to calculate future cashflows of large corporates, then this is discounted into the current price.

Be strategic when taking risk – One size doesn’t fit all!!

You may be able to take a higher risk with your pension than for an investment to provide a fund for education for example. This is often down to how long you can stay in the market, pension investments pre and post-retirement are usually over a longer term. Rather than focusing on your overall attitude to risk, consider it in terms of the objective you are aiming to achieve.

If you set out a clear objective and focus on what you wish to achieve there are several key factors to consider to make sure your investment is meeting your needs.

- Uncertainty: It’s part of the life we live. Every day brings different challenges and so too many opportunities. Investing is no different. We must ride out the challenges to reap the rewards of growth.

- Planning: With a plan you get to navigate where you hope to get to. With an investment professional to help guide you and keep you on track.

- Diversified Portfolio: Diversification is key in investing. This gives you growth assets such as equities, properties, and commodities as well as defensive assets like bonds and cash.

- Compounding: With the compounding effect on most gross roll-up products, you can avail of the full rate of growth for up to 8 years before you pay the tax on the gains.

- Term: Investing should be for at least 5 years. Time in the market in itself will smooth some of the uncertainty. What is down today is likely to be up in 1 or 2 years.

I started on my own journey into this business in September 1987, a month later on 19th October 1987, we suffered what was referred to as Black Monday. The market lost 22% in a day. I’ve witnessed the dot com bubble in 2000, financial crises in 2008, and many others over the past 35 years. The one thing for certain is that wise investors seek these times as buying opportunities. Not a time to make a hasty exit. The question is whether this is another one of these events?! Only time will tell.

If you’d like to have a chat about your own investment goals and the direction you’d like to go, please do get in touch for an initial chat.